who pays sales tax when selling a car privately in illinois

Heres a vehicle use tax chart. Uvp lax airport parking contact number Post comments.

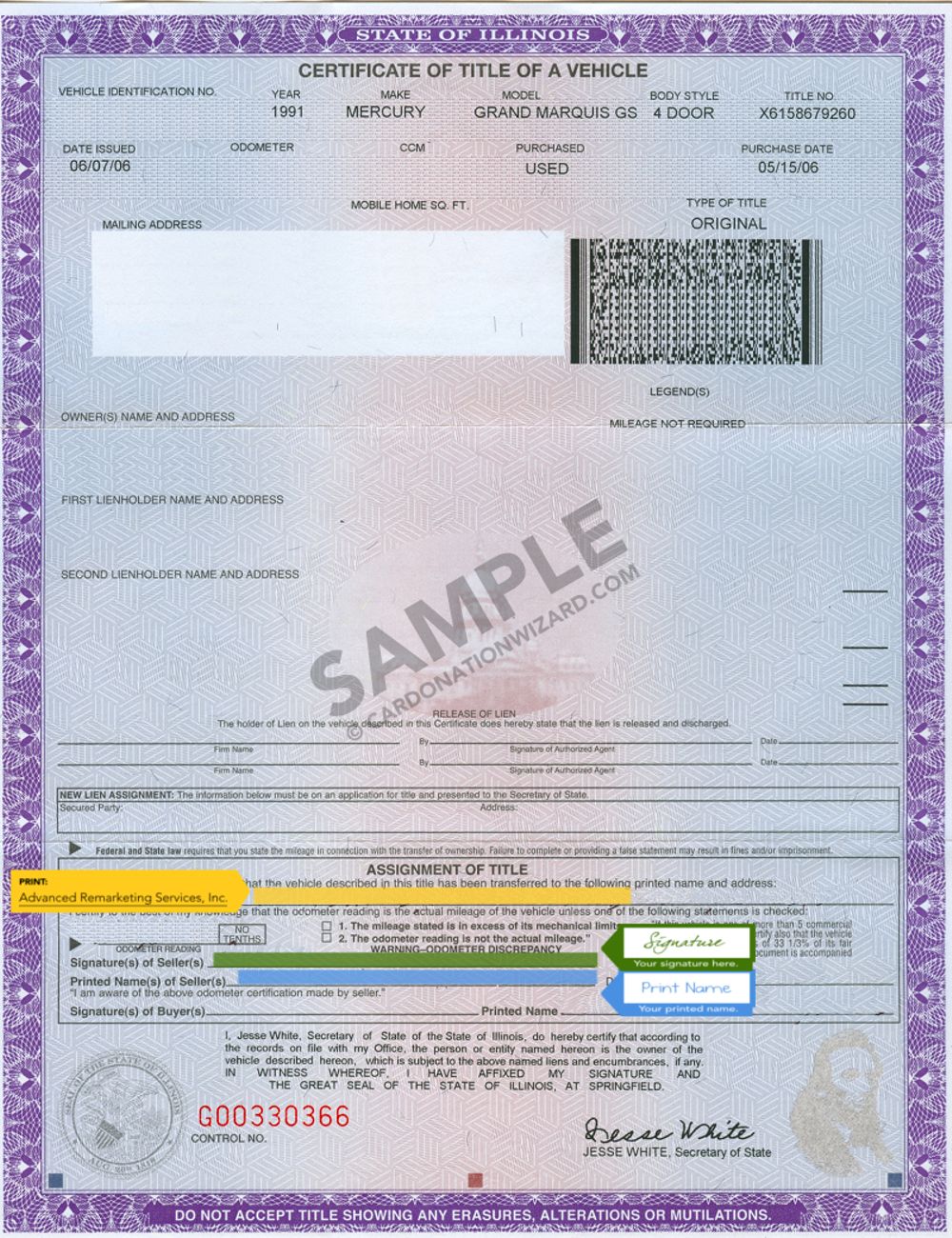

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000.

. Apartments for rent foothills az apartments for rent foothills az. This means you do not have to report it on your tax return. How do i sell my car privately in illinois.

If you sell it for less than the original purchase price its considered a capital loss. This tax is paid directly to the Illinois Department of Revenue. Is it cheaper to buy a car in IL or MO.

Many states offer a trade-in tax exemption that lowers the amount of sales tax youll pay in the trade. If you sell a vehicle to a customer who will title it in one of those states then you must charge the customer Illinois sales tax at the foreign states tax rate or at 625 whichever is less. 2 way slashing playmaker pf 2k22 on how do i sell my car privately in illinois.

You typically have to pay taxes on a car received as a gift in Illinois. Tax will then be due on THAT amount PLUS penalties. Who pays sales tax when selling a car privately in Illinois.

Who pays sales tax when selling a car privately in Illinois. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle.

If you sell more than five or if you buy even one vehicle for the purpose of reselling it you must have a de aler license. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. Remove the previous owners license plates.

Remove the License PlatesStep 4. By law a dealer has 20 days to send your title transfer and sales tax to the Secretary of States office. However there WILL be an audit by the Illinois Department of Revenue that shows the fair market value is 60000.

The car was an. It is illegal to operate a vehicle with someone elses license plates. As the owner of the vehicle the lessor generally is liable for Illinois Use Tax and responsible for filing and paying this tax using Form RUT-25-LSE when the vehicle is brought into Illinois.

For vehicles worth less than 15000 the tax is based on the age of the vehicle. By law a dealer has 20 days to send your title transfer and sales tax to the secretary of state s office. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

To transfer your license plates after you sell your car in Illinois you will need to submit an Application for Vehicle Transaction s Form VSD 190 to the IL SOS in person. A list of all the states for which you must collect sales tax and the rate you must charge can be found on the Illinois Department of Revenues website at. However there WILL be an audit by the Illinois Department of Revenue that shows the fair market value is 60000.

The tax owed is due. In addition to completing the application form you. In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets.

Income Tax Liability When Selling Your Used Car. It ends with 25 for vehicles at least 11 years old. When you sell your car you must declare the actual selling purchase price.

If for example you and the dealer negotiate a. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation. Who pays sales tax when selling a car privately in Illinois.

The buyer must pay 95 to the secretary of state and a tax to the department of revenue. The tax rate is based on the purchase price or fair market value of the car. Who Pays Sales Tax When Selling A Car Privately In Illinois.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. Do you have to pay taxes on a car thats a gift in Illinois. You will need Form RUT-50 to report the gift.

You can also pick up a form at the Illinois SOS office or request one to be sent to you by calling 800 252-8980. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val- uation. However if you sell it for a profit higher than the original purchase price or what is.

However you do not pay that tax to the car dealer or individual selling the car. How To Sell A Car In Illinois By OwnerHow to Sell a Car in IllinoisStep 1. You may qualify for a tax exemption if.

Cost of Buying a Car in Illinois Increased in 2020. When buying a used car privately it is important to know that there will be taxes applicable. You will pay it to your states DMV when you register the vehicle.

For vehicles worth less than 15000 the tax is based on the age of the vehicle. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

Wisconsin law says you can sell up to five vehicles titled in your name in 12 months. February 23 2022 Post category. If purchasing a vehicle from a private indi-.

Buyers must pay a transfer tax when they buy a car from a private seller in Illinois although this tax is lower when you buy from a private party than when you buy from a Dealer. Allow the Buyer to Have the Vehicle Inspected by a Third PartyStep 2. But these taxes are not paid to the seller.

However you the lessee may be required to assume this responsibility. Clean Out the VehicleStep 3. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

There is a problem with the title or the vehicle. It starts at 390 for a one-year old vehicle. Prepare Bills of Sale for Both Yourself and for.

Get a dealer license to sell more than five vehicles a year. Contact the DMV Dealer Agent Section at 608 266-1425 or.

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

What Is Illinois Car Sales Tax

Do I Pay Illinois Taxes When Buying A Car In Illinois Illinois Legal Aid Online

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

Virginia Sales Tax On Cars Everything You Need To Know

Illinois Used Car Taxes And Fees

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

550m Santander Car Loan Class Action Website Is Active Top Class Actions